Transportation in India: Today & the Future

Consumer behavior, public investments and the startups building to growing trends

Within the past three years, the Government of India has committed trillions towards infrastructure development. Meanwhile, private startups are eager to provide improved product solutions for existing players in the country’s Ola & Maruti Suzuki dominated markets. While anyone who has spent a day in Delhi can tell you that it can take 2 hours to get to Gurgaon from almost anywhere in the city at rush hour, I write below of where Indian transportation stands today, consumer purchasing patterns and trends supported by recent startups including but not limited to the push towards EV.

Where is India today?

According to the World Bank, around 65% of Indian’s live in rural regions while around 33% live in urban areas. The average salary in India (as of July 2021) is 31,900 INR, or around 430 USD per month. Urban migration is rapidly growing and, by 2030, 40% of the country is expected to live in urban regions; however, the majority of India’s population still lives in rural areas. Due to this and more, the primary method of transportation across the country remains walking followed by cycling. Even considering the average city across the country, half of the poor in Indian cities walk or cycle to work because of access or cost, suggests the Indian Exclusion Report 2018-2019.

As you move into Tier 1 and 2 cities in the country, a varying reality emerges. The average citizen of New Delhi makes 3.9 lakh per year (~5100 USD/year) while one in Mumbai makes around 4.4 lakh per year (~5,700 USD/ year). This growing middle class remains the primary target for most vehicle purchases across the country, while publicly ventures aim to increase affordability & interconnectedness for all.

Current Market: Price Sensitivity & Scooters vs Cars

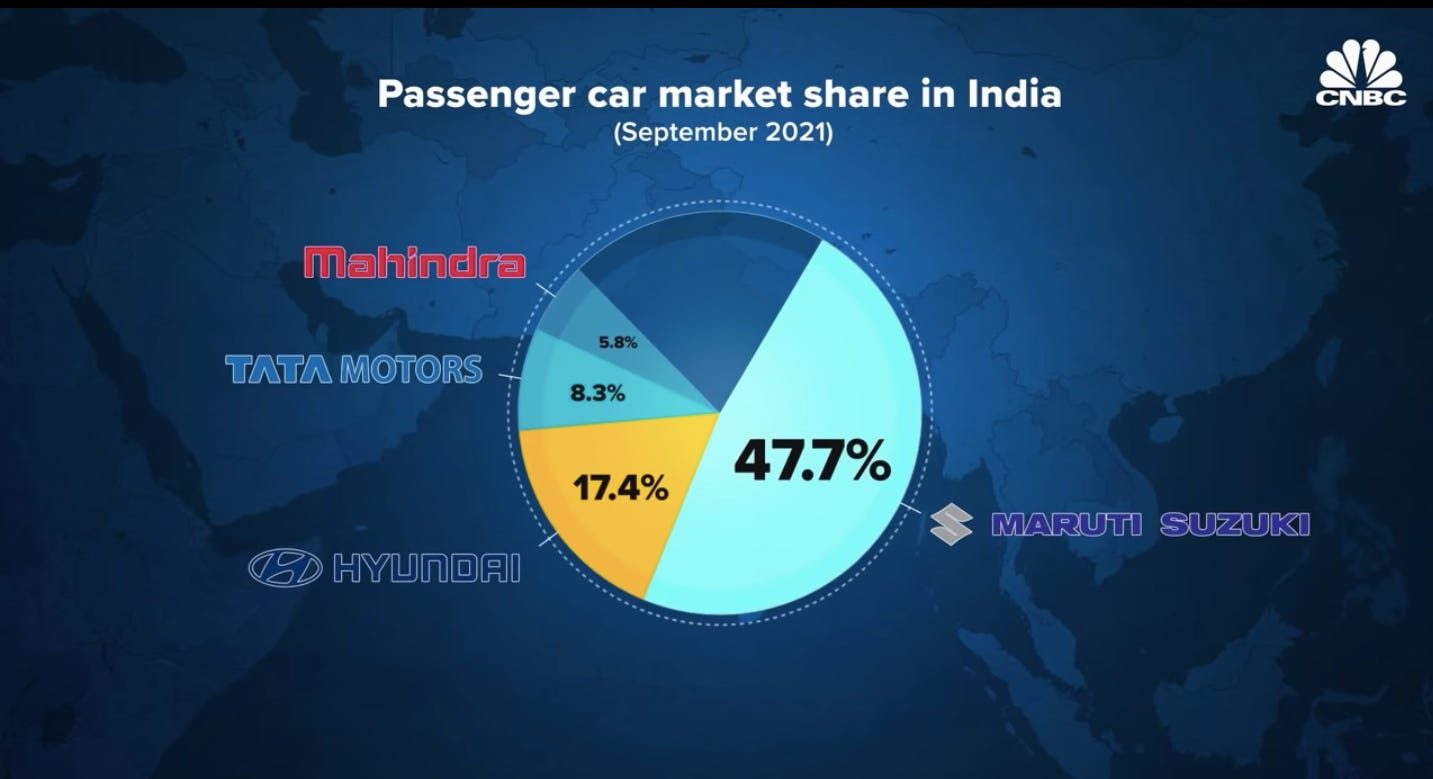

As a result of the wide variety of low cost options available in India, the vehicle market is extremely price sensitive. In this environment, scooters by far dominate over vehicles with around 80% of annual automotive sales being for scooters. Some of the most popular brands include Maruti Suzuki and Honda with products such as the Suzuki Access 125 and Honda Activa.

However for cars, Indian purchasing patters are far more conservative. For context, in 2021, around ~3.5 million were sold in India relative to ~ 25 million in China. In fact, only around 22/1000 Indians even own a passenger vehicle. Of the 3.5 million cars sold, most were relatively low cost with 80% for <12,000 USD and 95% sold for <20,000 USD.

By far the most successful car company in India is Maruti Suzuki. With first mover advantage (the first foreign car manufacturer to enter the country), it was able to quickly tackle the three P’s of product, price and place. By focusing on low cost but reliable vehicles, and developing a vast distribution network throughout the country, the company continues to be the primary leader of India’s car market. Most car dealerships in India focus on one specific car manufacturer rather than multiple as is common in the United States, so that early establishment of car dealership networks, particularly for lower cost cars, continues to favor Maruti Suzuki sales today.

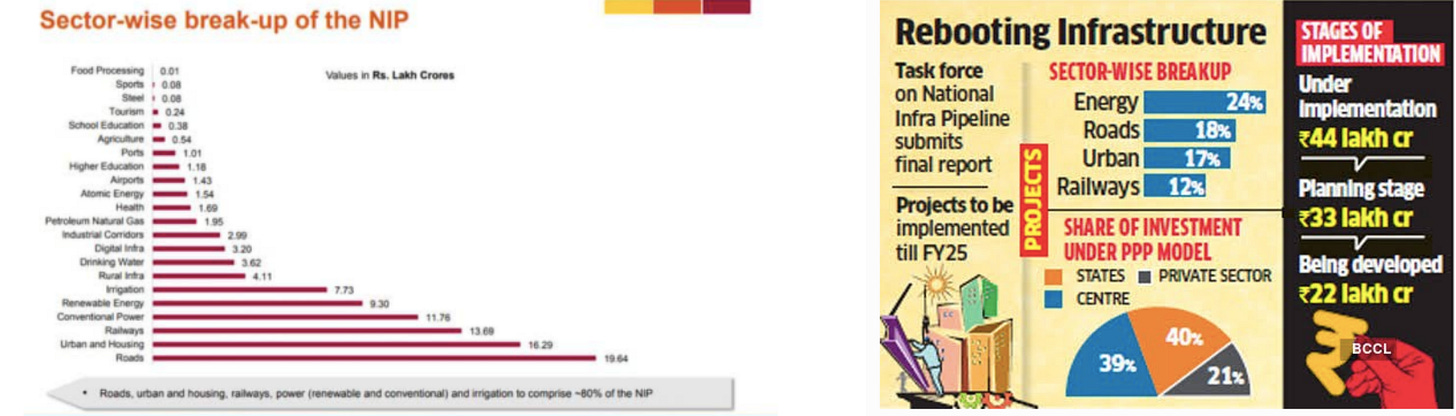

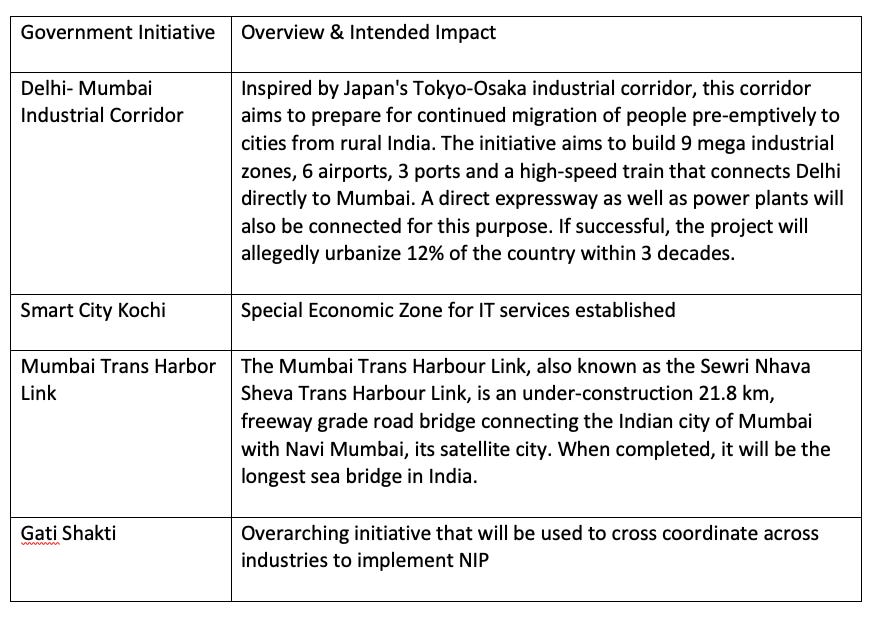

Government Plans for Public Transportation: NIP (National Infrastructure Pipeline) Plan

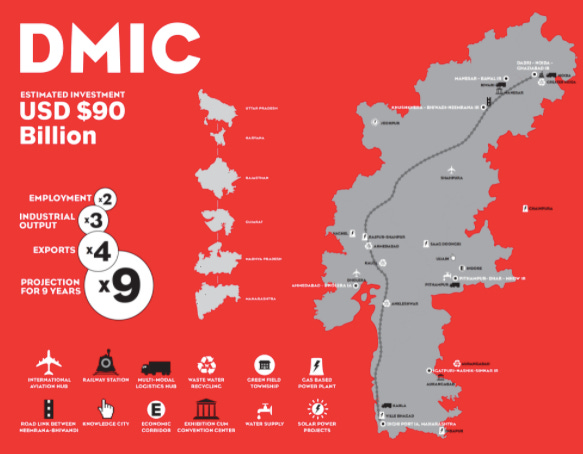

NIP is a central government initiative that aims to develop transportation and energy services to fast track the development of India as the population grows and urbanizes. By and large, the NIP, is the primary indicator of public infrastructure and transportation development in the country.

Railways: Widely Used but Falling Short

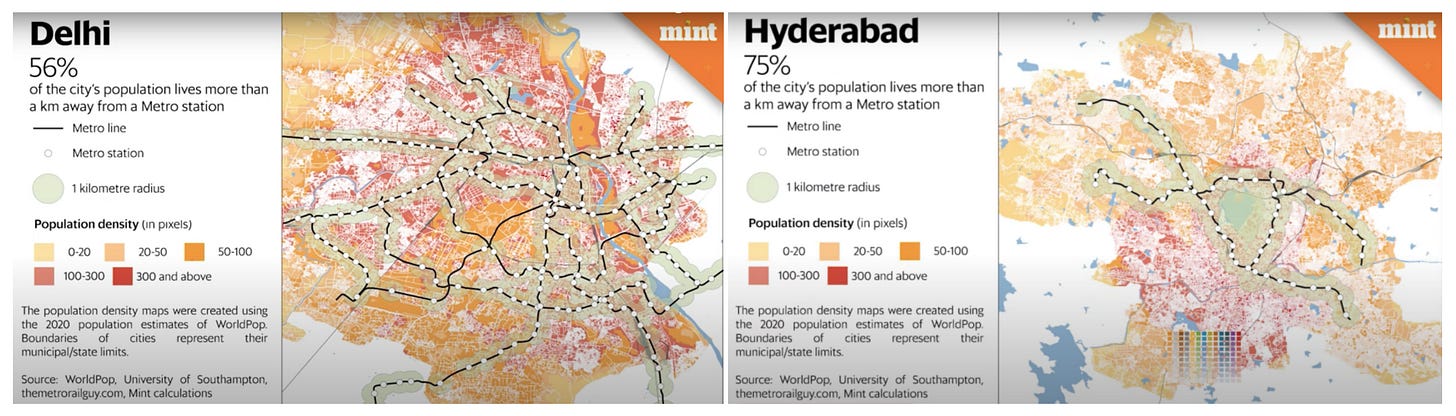

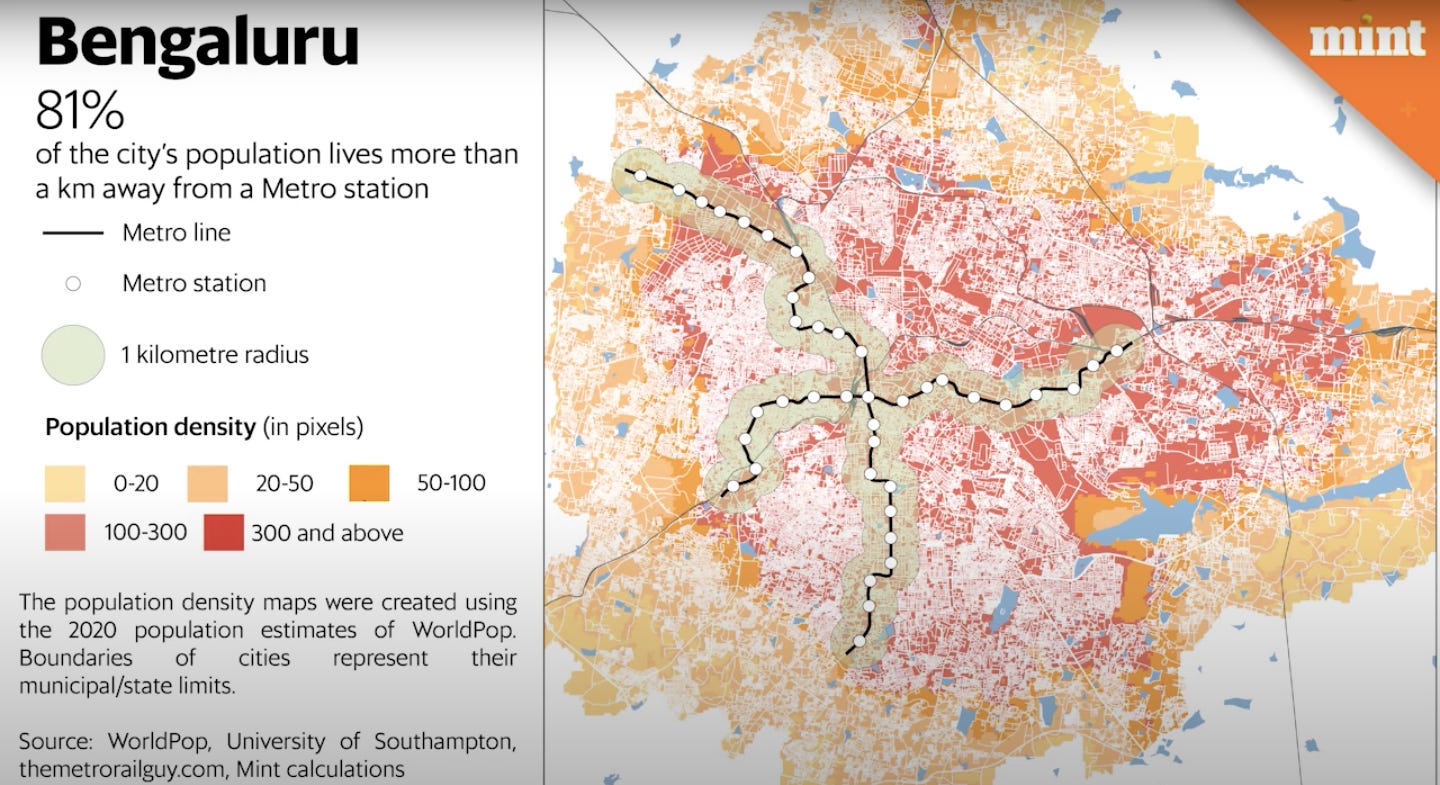

As the worlds 3rd largest railway network by size, the metro is one of the primary means of travel, particularly across urban regions of India.

Although the capital, Delhi, receives significant central funding (8,500 crores most recently in 2021) for the development of metros, most individuals remain upwards of a km away from a metro station. Thus, rapidly growing the rail network is among the key goals of current public infrastructure development.

This past year the Indian Railway launched the National Rail Plan also known as Vision 24 to accelerate development of the metros, including upgrading speeds on highly used routes, supporting electrification, and building alternatives to congested routes by 2024. The success of such a program is to be determined, but will be crucial in supporting urbanization in major cities.

Electric Vehicles: The Increasingly Near Future

With heavy subsidies supported by the Indian government, electric vehicles are slowly growing in purchase volume, with a myriad of companies working hard to attract this share of the market.

Per McKinsey’s article, *The unexpected trip: The future of mobility in India beyond COVID-19, ”the FAME (*Faster Adoption and Manufacturing of Hybrid and EV) program, which was first implemented in 2015 and updated in 2019, provides consumers and domestic companies with various incentives (to build and manufacture EV’s). For instance, in phase two of FAME, the government announced an outlay of $1.4 billion through 2022. In addition to subsidizing EV purchases and essential infrastructure development, the funding will provide local manufacturers with incentives to produce EVs.”

The largest use of electric ‘vehicles’ likely lies in electric rickshaws with ~15 lakh registered across the country in 2021. Even that number is likely an underestimated value given that not all e-rickshaws are officially registered. Indian electric rickshaws use is expected to grow around 33% per year between 2020 and 2025, an encouraging sign for public & widespread use of electric vehicles.

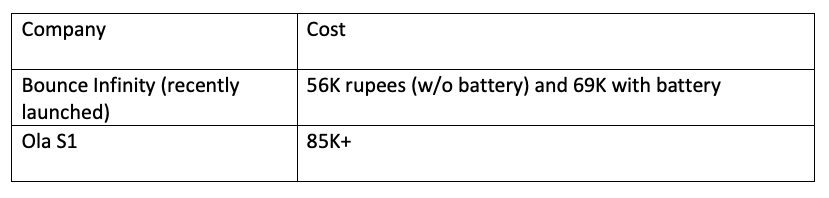

However, relatively speaking, the far majority of EV buyers in India are for scooters & 2 wheelers- not cars. Ola Cabs, India’s largest ride sharing service, now includes Ola Electric, a subdivision of the company that aims to lead the rise of electric scooters in the country. Within this market is where startups like Bounce Infinity, India’s first electric scooter with a fully swappable battery system, are eager to grow. The USP of Bounce Infinity lies in the fact that consumers can buy scooters without the battery, significantly bringing down costs.

Beyond owning the vehicles directly, there are vehicle sharing services that prove even more affordable and environmentally friendly, and that are increasingly growing in popularity. BluSmart, is an all-electric ride-hailing mobility service operating out of Gurgaon that aims to fill this niche with vehicles. Meanwhile, even cheaper include Yulu Bikes, electric bicycles that are essentially akin to Citi Bike in cities like Bangalore and Pune.

Even beyond the vehicles themselves, is the infrastructure that enables this rise of EV transportation. Startups like Statiq, funded by Y combinator (S20) among others, aim to be the foundational backbone of this rise by developing ‘India’s largest EV charging network’.

In later articles, I will do in-depth reviews of each of these companies as well as directly interview some of the founders of the organizations mentioned; but for now a few things are clear: Although there is much to be done, momentum in directly tackling transportation and the problems surrounding it have never been higher. Understanding where the market stands today is necessary to better understand the role that each of these startups aim to fill.

In this newsletter, I aim to break down industry trends, interview founders and provide market overviews for companies building for India and more broadly, South East Asia. Find me on twitter here: https://twitter.com/SridharNitya

Waoooo 🍇 message

Proud of you!